The Changing Landscape of B2B Sales and Marketing

Traditional approaches to B2B sales and marketing are facing obsolescence. Typically, B2B sales and marketing teams follow a linear path, with marketing engaging potential buyers early in their purchasing journey through digital content nurturing. Once these leads are deemed "marketing qualified," individual sales representatives take over, pursuing them through in-person or virtual interactions. This handoff from marketing to sales marks the transition from online customer engagement to in-person engagement.

Even in more advanced approaches like account-based marketing, this linear model remains largely unchallenged, with marketing preceding sales. Decades of efforts to integrate sales and marketing have focused on ensuring a seamless transition from digital to human selling, eliminating friction and aligning metrics, data, and even incentives and reporting structures.

The Emergence of Digital B2B Buying

However, B2B buying behavior has evolved significantly toward digital dominance, rendering much of this traditional commercial model outdated and nearly obsolete. For instance, Gartner research reveals that B2B customers spend only 17% of their total buying time directly interacting with supplier sales teams. Instead, their purchasing activities involve independent online learning (27%), offline learning (18%), and consensus-building among various internal and partner stakeholders (22% and 11% respectively).

Furthermore, the 17% allocated to supplier interaction is divided among all suppliers vying for the same opportunity. Thus, any given sales team has a very limited window of opportunity to engage directly with a customer, possibly as little as 5% or 6% of total buying time.

This restricted access represents a significant challenge for sales teams, limiting their ability to influence customer buying behavior. Many sales leaders find that they have few opportunities to impact purchase deliberations, resulting in minimal "surface area" for actual selling.

The Shift Towards Multi-Channel Buying

Today's B2B buyers heavily rely on digital information throughout their buying journey. In a survey of over 1,000 B2B buyers involved in complex purchases, respondents reported using digital channels, including a supplier's website, as frequently as interacting with sales representatives to gather information needed for various buying stages.

Sales leaders aiming to regain customer access have realized that customers never truly sought seller access in the first place. Instead, they sought sales conversations as a practical means to acquire specific information necessary for their buying process. With much of this information now available online, sales representatives have transitioned from being the primary channel to just one of many.

Despite the challenges individual sellers face, organizational leaders must recognize that helping B2B buyers purchase is more of an information challenge than a sales challenge. Companies that excel at providing customers with urgently needed information through preferred channels are better positioned for success in today's evolving digital commercial landscape.

Shifting Preferences Towards a Rep-Free Buying Experience

Many B2B buyers, especially those involved in complex solutions, are increasingly expressing a strong preference for a purchase experience that does not involve interactions with sales representatives. A survey of nearly 1,000 B2B buyers revealed that 43% of respondents would prefer a buying experience without the involvement of sales reps. When considering generational differences, 29% of Baby Boomers preferred rep-free buying, while a significant 54% of Millennials shared this sentiment. This data highlights a potential generational shift in customer engagement preferences that could have significant implications over the next five to ten years.

While it may seem extreme to predict the "death of sales," this interpretation of the data is unrealistic. Complex solutions often require collaborative customization, necessitating human interaction, and sales reps are viewed as essential in B2B buying. Additionally, current B2B buying experiences are not advanced enough to fully support customers who prefer to make purchases entirely on their own.

Customers Can't Buy Alone, But They'd Prefer To

While today's customers cannot purchase complex solutions without sales rep involvement, many would prefer a self-service approach if it were feasible. This data underscores a growing disconnect between how suppliers sell and how customers prefer to buy. Suppliers are not aligning with customer preferences, creating a "preference gap" that exposes them to the risk of competitors or disruptors bridging this gap in innovative ways, akin to how the taxi industry faced disruption due to a gap between rider preferences and reality.

The Need for a Unified Commercial Approach

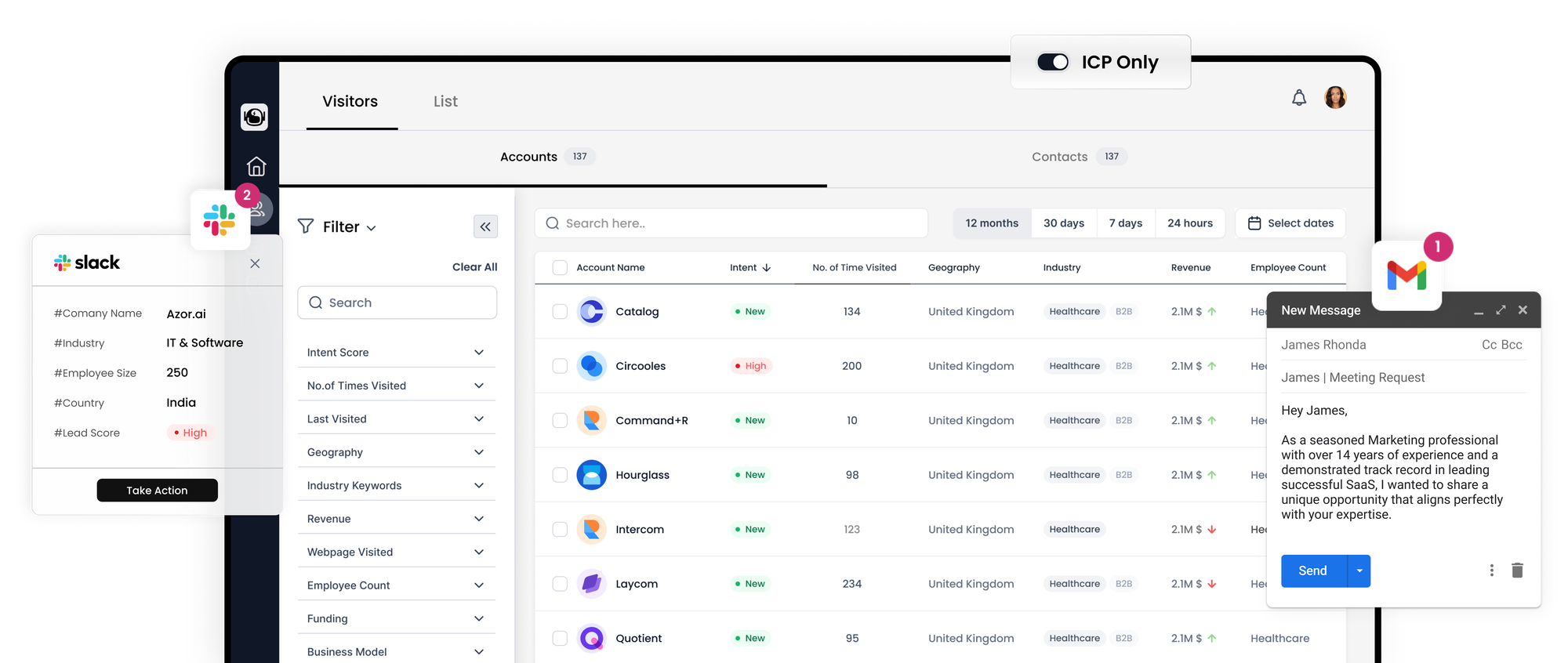

Changing buying behaviors are closely tied to organizational structures. The traditional linear commercial engine, which was once an accurate approximation of buying behavior, is now out of date and out of sync with how modern B2B buyers make purchases. In today's B2B buying journey, there is no single handoff from digital to in-person or from marketing to sales. Buyers are channel-agnostic in their behavior and digitally dominant in their preferences.

Customers may seek sales rep input at various stages of a deal but often return to digital channels to gather information or reevaluate their needs. In this new landscape, simply aligning sales and marketing functions falls short of addressing the radically different buying reality. A deeper transformation is required.

The Case of SMART Technologies

SMART Technologies, based in Calgary, Canada, recognized the growing misalignment between how they were selling and how their customers were buying. They observed the limitations of better alignment between commercial functions and decided to dismantle traditional silos of sales, marketing, success, and service. They reconfigured these functions into what they call the "Unified Commercial Engine" (UCE).

The UCE was designed by mapping customers' buying journeys and identifying five common buying jobs. Each job is supported by a specific internal team, leading to the reassignment of over 250 team members from legacy roles. SMART also created centers of excellence to consolidate efforts across traditional functional boundaries.

Teams were organized into geographically aligned "pods," with each pod responsible for supporting all buying jobs in a given region across various channels. A UCE dashboard provided metrics, and pod leaders ensured buyers received the necessary support through the appropriate channels and at the right times.

The results were remarkable, with lead volume up by 50%, lead acceptance increasing by 35%, and year-over-year growth at an impressive 48%. Jenna Pipchuk, formerly the head of sales, and Jeff Lowe, formerly the head of marketing, now describe themselves as part of the Unified Commercial Engine, highlighting the transformation that was necessary to adapt to changing buyer preferences.

Embracing the New Era of B2B Buying

The future of B2B sales and marketing lies in supporting the new era of B2B buying rather than clinging to traditional sales and marketing models. Adapting to this changing landscape requires a fundamental reevaluation and transformation of organizational structures to align with how customers prefer to purchase complex solutions.